If you have a doctor’s confirmation that you can’t see better than 20/200 in your better eye with glasses or contact lenses, or your field of vision is 20 degrees or less, you may qualify. These figures become more complex (and the standard deduction increases) if one or more partners in a marriage is blind.Ĭoncerning the blindness deduction: this increased standard deduction amount is available to those legally blind - and even for those not completely blind. The standard deduction for those over age 65 in 2023 (filing tax year 2022) is $14,700 for singles, $27,300 for married filing jointly if only one partner is over 65 (or $28,700 if both are), and $21,150 for head of household. The IRS considers an individual to be 65 on the day before their 65th birthday. However, if you are 65 or older on the last day of the year and don’t itemize deductions (or are blind), you can claim an additional standard deduction.

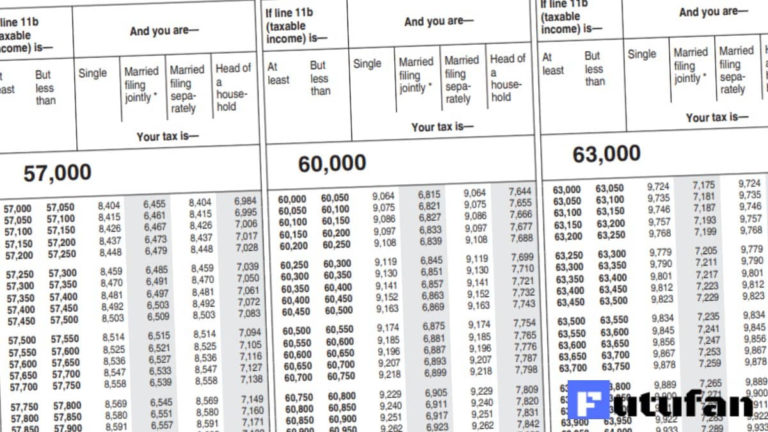

For tax year 2023 (filed in 2024), standard deductions have been increased to $13,850, $27,700 and $20,800 for singles or married but filing separately, married couples filing jointly (and surviving spouses) and heads of household, respectively. Per the IRS, the standard deduction amount for tax year 2022 (filed in 2023) is $12,950 for single filers, $25,900 for married couples and $19,400 for heads of household. Important: 3 Signs You’re Serious About Raising Your Credit Score

#Federal tax brackets 2021 over 65 how to

Read: How To Avoid Paying Taxes Legally - and the 11 Craziest Ways People Have Done It The standard deduction for those over age 65 in 2023 (filing tax year 2022) is 14,700 for singles, 27,300 for married filing jointly if only one partner is over 65 (or 28,700 if both are), and. 2017, new income brackets and standard deduction amounts came into effect that changed how much Americans pay in taxes - and how they file their deductions.

The 2019 standard deduction is increased to 24,400 for married individuals filing a joint return 18,350 for head-of-household filers and. For more on the tax brackets and income ranges visit our website at. Single, head of household, qualifying widow(er), married filing separately and living apart from spouse. Major tax bracket changes occurred for 2018 and remain for 2019 with rates at 10, 12, 22, 24, 32, 35, and 37. When former President Donald Trump overhauled the U.S. 2021 if the federal income tax return deadline for the business that maintains such plans is April 18, 2022, and federal income tax return extension was filed for such.

0 kommentar(er)

0 kommentar(er)